Can Mandatory Provident Fund (MPF) Scheme benefit, Occupational Retirement Scheme benefit or Gratuity be used to offset Severance Payment or Long Service Payment?

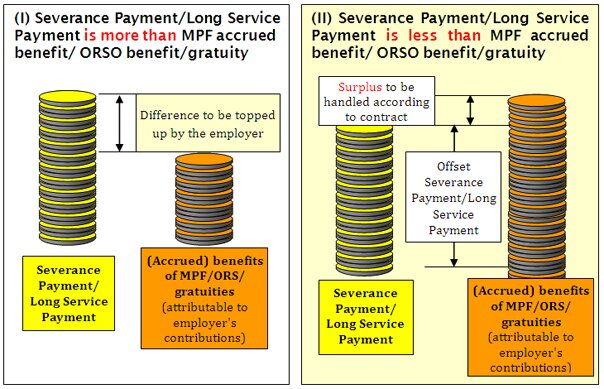

Labour DepartmentThe accrued benefit held in the MPF scheme, gratuities based on length of service, or occupational retirement scheme benefits, can be used to offset severance payment or long service payment; but is limited to the part attributable to employer's contributions only. Hence the amount of severance payment or long service payment that needs to be made by the employer can be reduced according to the calculation method shown below. The amount that can be offset is as follows -

- If the aforesaid payments exceed the severance payment/long service payment, the employer can only reduce an amount equivalent to the severance payment/long service payment; and

- If these payments fall short of the severance payment/long service payment, the employer is required to pay the difference.

- For enquiries on application for payment of an amount from the occupational retirement scheme benefits or accrued benefits in the MPF scheme, please contact the trustees concerned for details; or contact the Mandatory Provident Fund Authority (Tel: 2918 0102) for enquiries.

The is not a legal document. The Ordinance remains the sole authority for the provisions of the law explained.

Last update: 30 Sep 2019

Want to learn more?

Want to learn more?