Why employers dismissing employees before 1 May 2025 (transition date) will not save SP/LSP expenses?

Labour DepartmentThe following arrangements will be put in place in respect of the pre-transition portion of severance payment (SP)/long service payment (LSP) of employees whose employment commences before the “transition date”:

- Pre-transition portion of SP/LSP will be calculated on the basis of the wage rate as at the “transition date” instead of that at the termination of employment. As such, regardless of any increase in salary or when the employment is terminated after “transition date”, the amount of pre-transition portion of SP/LSP would not increase; and

- For employees who leave employment after the “transition date”, employers can continue to use ERMC to offset employees’ pre-transition portion of SP/LSP.

Therefore, employers dismissing existing employees before the “transition date” will not save SP/LSP expenses.

Generally speaking, employers dismissing existing employees and hiring new employees will, in the contrary, incur higher SP/LSP expenses. The ERMC in respect of the existing employees’ whole employment period can continue to be used to offset their pre-transition portion of SP/LSP. Therefore, retaining existing employees allows ERMC to grow, which can be used to offset pre-transition portion of SP/LSP in future.

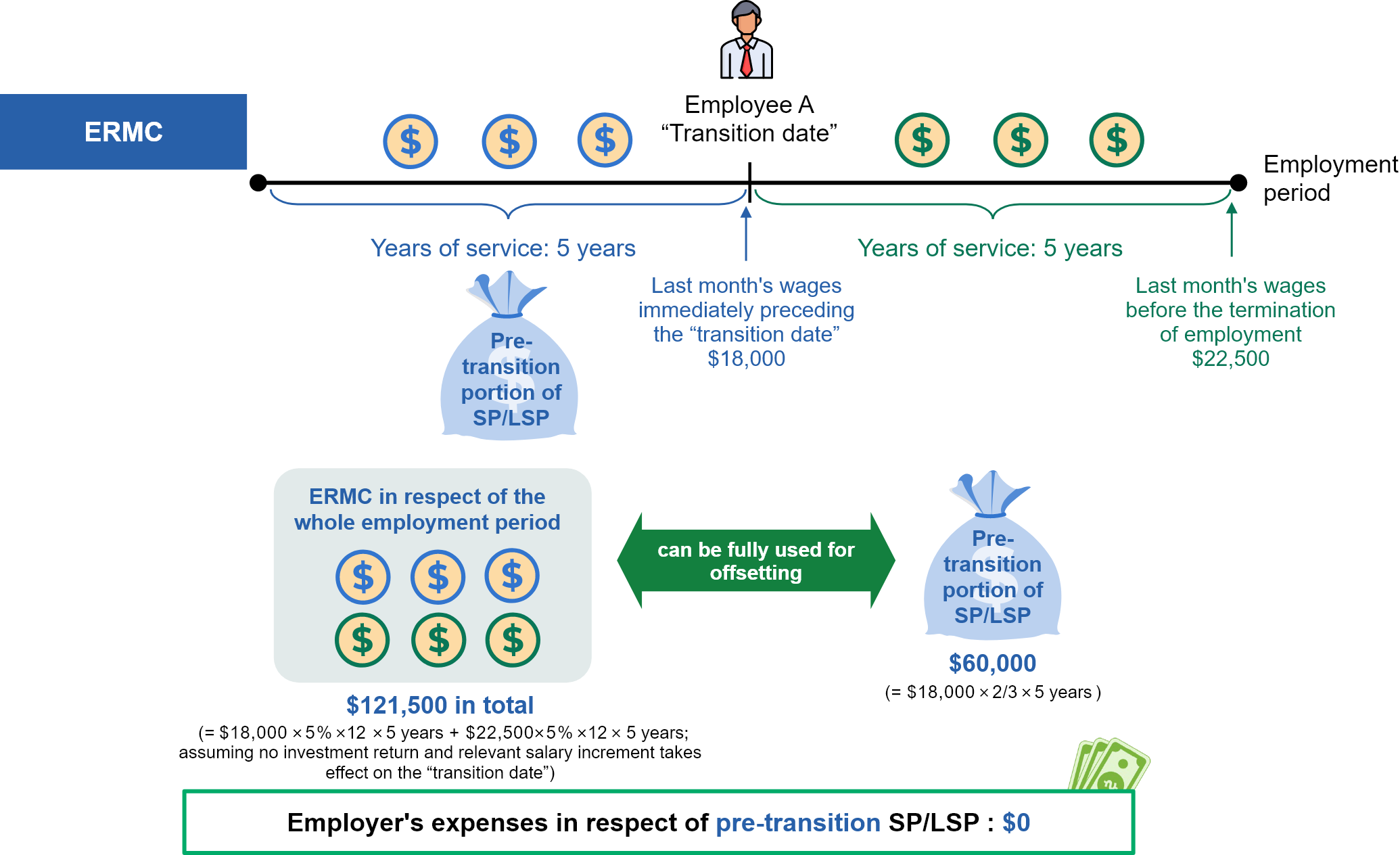

Example 1

Scenario 1: Employer continues to employ an existing employee after the “transition date”

Assuming an employer employs Employee A for 5 years before the “transition date” and continues to employ Employee A for 5 years after the “transition date”. Assuming the last month’s wages of Employee A immediately preceding the “transition date” is $18,000 whilst the last month’s wages before the termination of employment is $22,500.

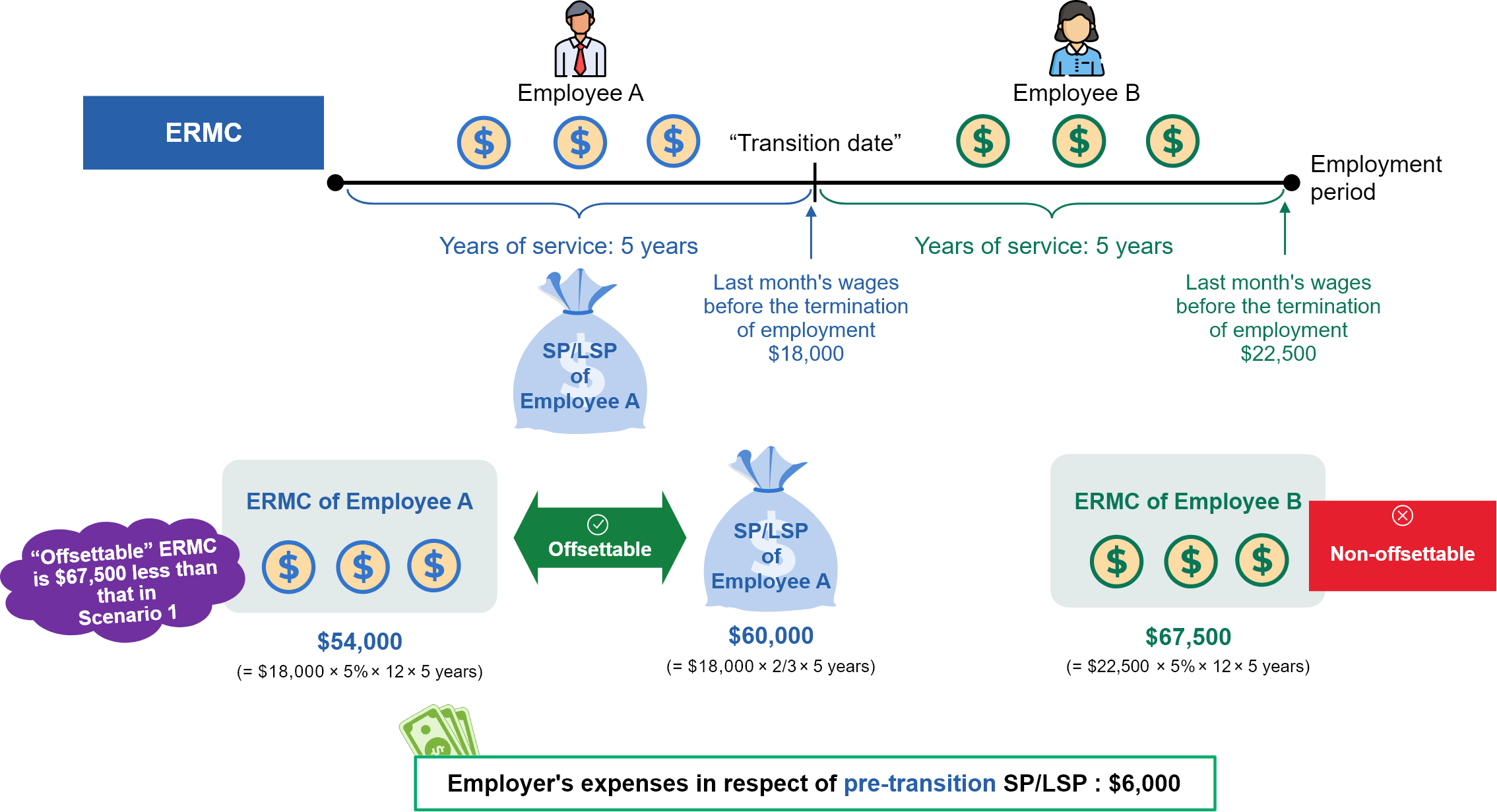

Scenario 2: Employer dismisses an existing employee before the “transition date” and employs a new employee after the transition

Assuming the employer dismisses Employee A who has 5 years of service before the “transition date” and employs a new Employee B for another 5 years. Assuming the last month’s wages of Employee B before the termination of employment is also $22,500.

The above example illustrates that if the employer dismisses an existing employee before the “transition date” and employs a new employee afterwards, an additional amount of $6,000 pre-transition SP/LSP is incurred. No matter the employer continues to employ Employee A or changes to employ Employee B, the amount of post-transition SP/LSP incurred are the same, which is $75,000 and non-offsettable.

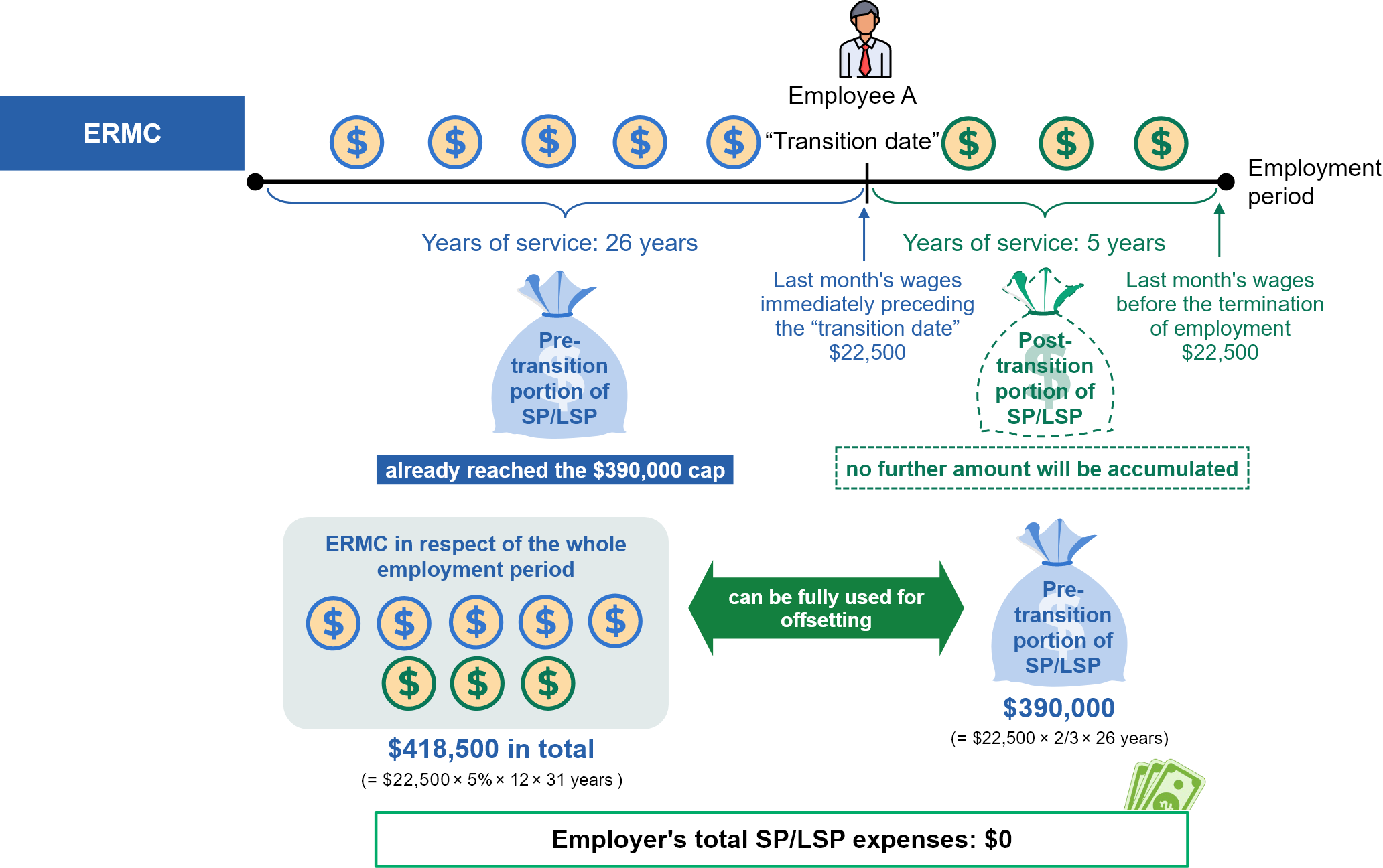

Besides, the maximum amount of SP/LSP (i.e. the sum of pre-transition and post-transition portion of SP/LSP) remains $390,000 after the abolition. The amount in excess will be deducted from the post-transition portion.

Assuming an employee’s SP/LSP has already exceeded $390,000 before the “transition date”, and the employer continues to hire that employee after the abolition. Since the amount in excess of the cap will be deducted from the post-transition portion, no further post-transition portion of SP/LSP can be accumulated. In other words, his/her SP/LSP entirely belongs to pre-transition portion and can still be offset by ERMC no matter when the employee leave employment after the “transition date”. On the contrary, if the employer dismisses the employee before the abolition and hire a new employee after the “transition date”, the new employee’s SP/ LSP will build up afresh to a maximum of $390,000, and cannot be offset by ERMC. This will instead incur higher SP/LSP expenses for the employer.

Example 2

Scenario 1: Employer continues to employ an existing employee after the “transition date”

Assuming an employer employs Employee A for 26 years before the “transition date” and continues to employ Employee A for 5 years after the “transition date”. Assuming the last month’s wages of Employee A immediately preceding the “transition date” and before the termination of employment are both $22,500.

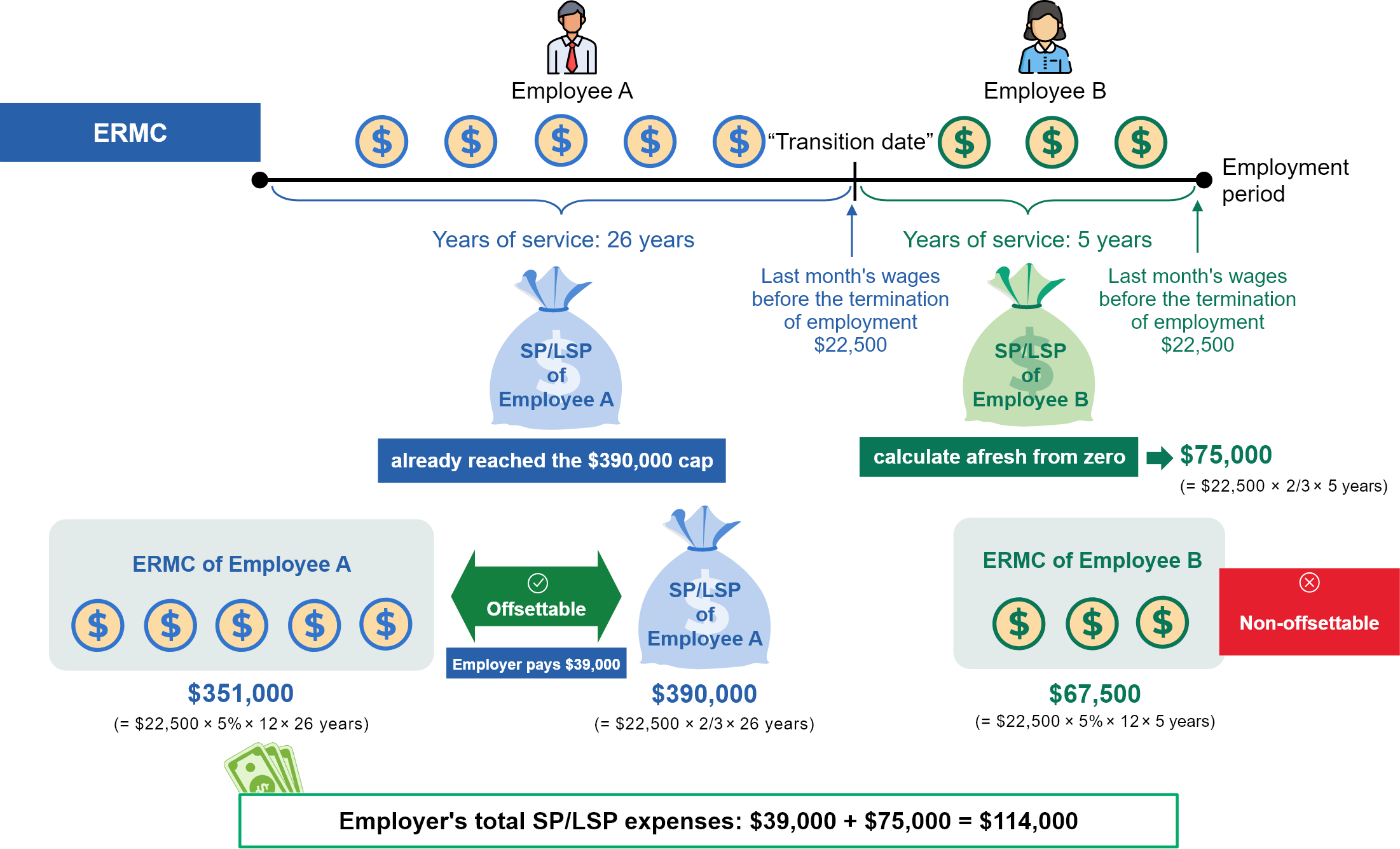

Scenario 2: Employer dismisses an existing employee before the “transition date” and employs a new employee after the transition

Assuming the employer dismisses Employee A who has 26 years of service before the “transition date” and employs a new Employee B for another 5 years. Assuming the last month’s wages of Employee B before the termination of employment is also $22,500.

The above example illustrates that if the employer dismisses an existing employee before the “transition date” and employs a new employee afterwards, an additional amount of $114,000 SP/LSP is incurred.

This is not a legal document. The Ordinance remains the sole authority for the provisions of the law explained.

Want to learn more?

Want to learn more?